Credit scores tell lenders, employers and landlords a lot about a person – how often someone applies for loans or credit cards, the amount of credit owed or if there are any missed payments will affect your credit score. Because our credit score matters when making large purchases, it’s important to make sure yours is in good standing. Here are a few ways you can improve your credit score.

Your Credit Report Should Be Accurate

All of the information that your credit score is based on is found on your credit report. Check this report every year through major credit bureaus such as Experian. Ensure that all of your information is correct and up to date on the report. If something doesn’t look right, dispute it with the bureau or the lender.

Get Late Payments on Track

Payment history counts towards 35% of your credit score. Late payments can stay on your credit score for up to seven years. If you’re struggling to pay your creditors on time, don’t be afraid to reach out to them. Most companies will be flexible and forgive a late payment.

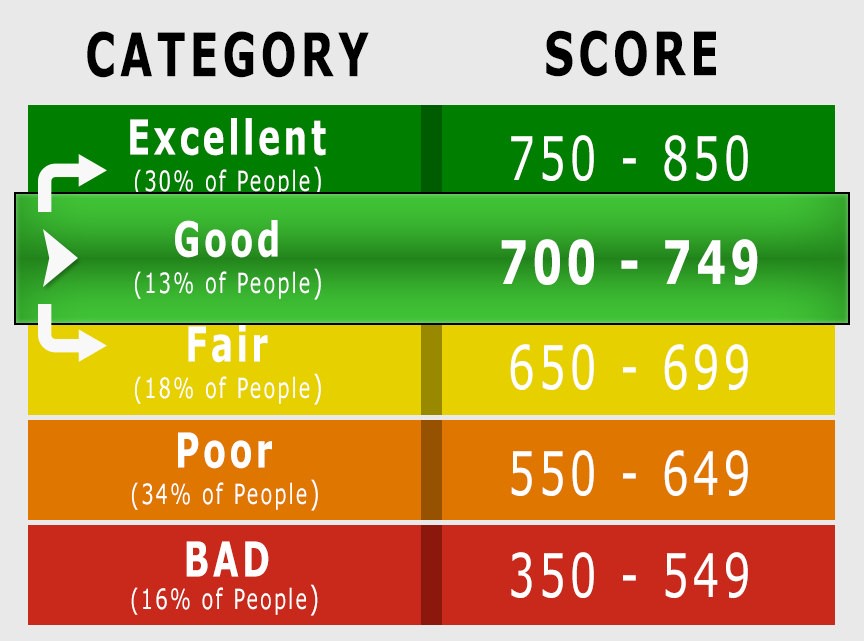

Image Credit

Invest in an IFA

If you are having trouble with your credit score, an IFA can help you get back on track. The software for IFAs will allow you to know the best way of boosting your credit score to where you want it. Do you use software for IFAs? Some great software for IFAs can be found at Intelliflo.

Work on Your Credit History

The longer you have had a line of credit open, the stronger your credit score will be. Your credit history is usually around five years. So if you’re just starting out, get a credit card and make some affordable purchases. As you start to pay it off on time, you’ll establish a great credit history and show the lenders you’re a responsible borrower.

Get a Credit Card

If you’ve never had a credit card or have recently closed your lines of credit, it might be time to start establishing your credit score again. Before you apply for a new card, think about how you will be using it and find one that fits your needs and also gives rewards.