As we all know, the economic situation in which we live is leading us all to make certain adjustments in our daily lives. That is why yesterday we announced the beginning of several financial guidelines called “Take Control of your Money” on the handling of budget and control of expenditures in the face of the economic crisis. These guidelines will be offered in shopping centers around the island and, in addition, you can gather 20 or more people and coordinate a talk for your community or company.

Here we share with you 10 tips that can help you start managing your money better:

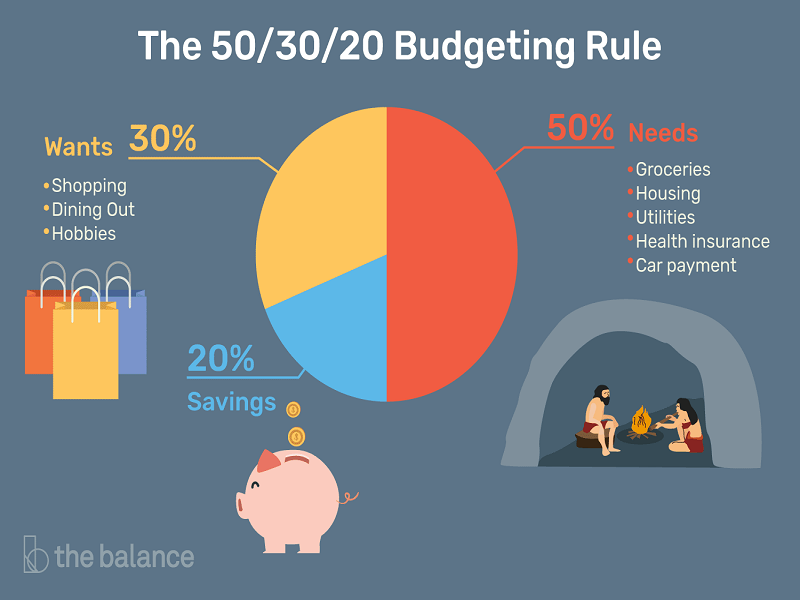

1. Identify needs vs. wishes. It is difficult to make and maintain a plan to manage your money if you do not know what your needs are. what are wishes Needs are essential things to live and desires are things that improve your quality of life. First you must make sure you have enough money to meet your monthly needs so that you can satisfy your wishes.

2. If you have a partner, make decisions with him or her. To establish a plan and fulfill it successfully, you must agree with your partner on how to do it. Both must take into consideration the needs and desires of each one and establish priorities.

3. Make a budget. Include all your income, debts and expenses: the mortgage, water, electricity, lunches, meals, etc. This will help you define where the money is going. Fill out the budget sheet .

4. Reduce your expenses List your expenses in order of importance. Which of them could you eliminate or reduce? Here are some tips to save more and spend less:

– Take lunch from home to work. Presuming that there are 20 working days in a month, you would be saving between $ 100 – $ 160 per month in lunches (if your lunch costs $ 5 – $ 8 per day respectively). This translates to $ 1,200 – $ 1,920 per year!

– Make certain adjustments to lower your light payment. Use the air conditioner only when necessary; otherwise use the fan. Use “multiplugs” for any electronic item that does not turn off completely. For example, items such as TV, home theater, game consoles, radio and computer continue to consume electricity even when they are “off”. When leaving your house, turn off the “multiplug” completely to make sure they are completely off. If you have to replace your stove or your heater, consider a gas stove or a solar heater.

– Analyze your cell phone plan. Many people think that downloading the minutes plan from the cell phone is the most obvious way to lower that expense, but if you go over the minutes of your plan, you may end up spending more. Analyze your voice plan and data and increase it if necessary to cover your monthly use.

– When you go to the supermarket, bring a list of what you really need and buy according to that. Avoid going hungry to avoid buying “with your eyes”.

5. Save Try to separate a monthly amount to save, it does not matter if it is not much. Transfer the amount you determine to the savings section or account as soon as you receive your fortnight or establish that the transfer becomes recurrent .

6. Do not touch your savings. Establish a separate emergency fund for your savings. The emergency fund should be 3-6 months of your monthly income. Put the savings in an account that is not accessible as a certificate of deposit.

7. Eliminate services that are not necessary .

8. Be creative. If you have to make gifts, give something special made by you or your family. A homemade dessert or a painting made by your child or a photograph can be more special for a family member than a purchased gift.

9. Stay informed. You do not have to be an expert in finance to be aware of what happens in the market. Ask about savings plans, variety of accounts, mortgages, etc.

10. Think of your family as partners. Meet with them periodically to discuss the budget and review goals and financial plans.