Transfer of equity is a process that should be fully understood before taking action. So, whether you are looking at removing someone from a property title, transferring ownership to someone else or making changes to the joint ownership of a property, here’s a guide to what you need to know.

What is a transfer of equity?

This term refers to the process of making changes to a property’s title deeds. This could mean removing or adding someone as owner.

Reasons to consider a transfer of equity

You may want to consider a transfer of equity for a range of reasons, including the end of a relationship, moving on to a new relationship, resolving joint ownership issues and increasing tax efficiency.

It is always important to get independent legal guidance from a reputable property solicitor. There is a range of options out there for legal advice, including conveyancing specialists such as https://www.samconveyancing.co.uk/news/conveyancing/transfer-of-equity-cost.

Transfer of equity: the process

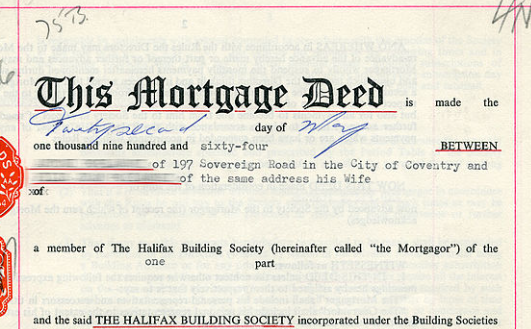

Your solicitor should guide you through this process. It starts with getting an official copy of the property’s title deeds, checking identities and discovering any restrictions or mortgages.

Your solicitor will draw up a transfer deed and notify any third parties, such as the mortgage lender. The deed will then need to be signed and independently witnessed and the Land Registry will need to be notified.

The transfer of equity costs for Land Registry transfer will depend on the property’s value. You can find out more about Land Registry involvement here.

How long will it take?

A simple transfer is likely to take between four and six weeks, but each case is different. Transfers where there is a mortgaged property will take longer due to needing the lender’s consent. Other legal issues, such as those which may arise during a divorce, may also cause delays.

Transfer of equity costs

Your costs will be made up of Land Registry and solicitor’s fees. There are other costs which may also apply, such as search fees for lenders and Stamp Duty Land Tax (SDLT).

Do mortgage lenders need to be contacted?

Yes, if a property has a mortgage, then lenders must be informed and their consent must be given. Your lender may want to look at the context of any transfer and will check on continuing owners and new owners. Your lender may give your solicitor a list of conditions in order for them to provide consent.

Do I need my own solicitor?

It is recommended by the Law Society that both transferors and transferees have their own solicitors in order to prevent any conflict of interest.